By Olivia Ndubuisi

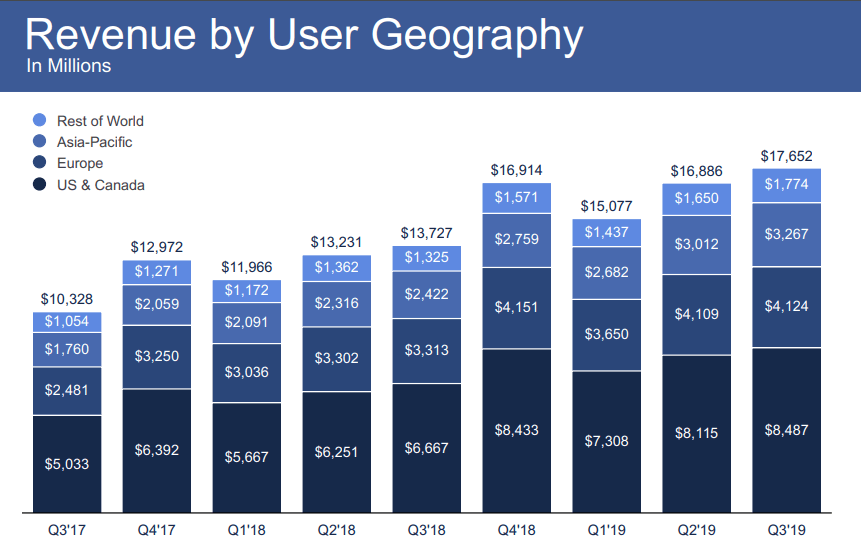

Google’s office at the airport residential area in Accra, Ghana, sits inside a plain white and blue two-storey building that could do with a coat of paint. Google, which made more than US$ 160 billion in global revenue in 2019, of which an estimated US$ eighteen billion in ‘Africa and the Middle East’, pays no tax in Ghana, nor does it do so in most of the countries on the African continent.

Google Street View of the building registered as Google’s office in Accra

Google Street View of the building registered as Google’s office in Accra

It is able to escape tax duties because of an old regulation that says that an individual or entity must have a ‘physical presence’ in the country in order to owe tax. And Google’s Accra office clearly defines itself as ‘not a physical presence.’ When asked, a front desk employee at the building says it is perfectly alright for Google not to display its logo on the door outside. ‘It is our right to choose if we do that or not’. A visitor to the building, who said she was there for a different company, said she had no idea Google was based inside. Facebook is even less visible. Even though practically all 250 million smartphone owners in Africa use Facebook, it only has an office in South Africa, making that country the only one on the continent where it pays tax

Advertisement

Brick and mortar

Tax administrations globally have initiated changes to allow for the taxing of digital entities since at least 2017. African countries still lag behind, which is why the continent continues to provide lucrative gains for the tech giants. A 2018 PriceWaterhouseCoopers report noted that Nigeria, Africa’s largest economy, has seen an average of a thirty percent year-on-year growth in internet advertising in the last five years, and that the same sector in that country is projected, in 2020, to amount to US$ 125 million in the entertainment and media industry alone.

‘Their revenue comes from me’.

Irish Double

Moustapha Cisse, Africa team lead at Google AI

Google Ghana is an ‘artificial intelligence research facility’.

Cash-strapped countries

Like most countries, especially in Africa, Nigeria and Ghana have become more cash-strapped than usual as a result of the COVID 19 pandemic. While lockdowns enforced by governments to stop the spread of the virus have caused sharp contractions of the economy worldwide, ‘much worse than during the 2008–09 financial crisis’, according to the International Monetary Fund, Africa has experienced unprecedented shrinking, with sectors such as aviation, tourism and hospitality hardest hit. (Ironically, in the same period, tech giants like Google and Facebook have emerged from the pandemic stronger, due to, among others, the new reality that people work from home.) With much needed tax income still absent, many countries have become even more dependent on charitable handouts. Nigeria recently sent out a tweet to ask international tech personality and philanthropist, Elon Musk, for a donation of ventilators to help weather the COVID 19 pandemic: ‘Dear @elonmusk @Tesla, Federal Government of Nigeria needs support with 100-500 ventilators to assist with #Covid19 cases arising every day in Nigeria’, it said. After Nigerians on Twitter accused the government of historically not investing adequately in public health, pointing at neglect leading to a situation where a government ministry was now begging for help on social media, the tweet was deleted. A government spokesperson later commented that the tweet had been ‘unauthorised’.

Cost to public

‘A tax paying people is a questioning people’

Interior view of the Facebook office in Johannesburg, South Africa

Waiting for the Finance Minister

He blamed the ‘complexity of developing robust infrastructure to assess e-commerce activity in the country’ as a major reason for the government’s inaction on this, but hoped that a broad digital tax policy would still be announced in 2020.” Until the authorities get around to this, he said he believed that, ‘Google and Facebook will (continue to) pay close to nothing in Ghana’.

By Olivia Ndubuisi Olivia Ndubuisi is a Nigerian broadcast journalist who loves investigations

Before it’s here, it’s on Elephant