by Mohamed Dubo

Jun 10, 2022 – 12:05 am GMT+3

The American philosopher and essayist Ralph Waldo Emerson may well have envisioned Somalia’s scenario when he famously observed “when the night is darkest, the stars come out.”

The last three decades have been particularly difficult for this Horn of Africa nation but thanks to the resilience of the people and the spirited efforts by government authorities and agencies, the stars on the people of Somalia have not been dimmed.

On the contrary, they have brightened the people’s resolve for private sector developments, following the government’s collapse in 1991, which led to a period of conflict, and socioeconomic and political instability.

Success in structural reforms

Since the 2012 establishment of the Federal Government of Somalia (FGS), a number of structural reforms have been put in place to boost domestic business and foreign direct investments (FDI).

The reforms have, over the last four years, mainly focused on fixing impediments faced by potential investors such as the lack of a comprehensive legal framework, a civil and commercial justice system, weak dispute resolution mechanisms, enforcing contracts and inefficient public financial management systems.

The overall enabling climate for investment similarly revolves around issues like land management, public procurement and disposal arrangements, banking regulations, contract management regulations, bilateral trade agreements, as well as free and responsible media. In all these areas, priorities have over the years been identified for policy, legal and regulatory improvements to remove these bottlenecks.

Pipelined reforms such as the person’s registration and issuance of digital identification cards (IDs) are expected to help expand the financial inclusion while at the same time enhancing the financial system’s integrity in line with the Anti-Money Laundering and Countering Financing of Terrorism Act of 2016. All these reforms will pave the way for effective public service delivery and foster the formalization and digitization of the economy.

Furthermore, the media landscape in Somalia is gradually stabilizing – thanks to the latest media reforms proposed by the FGS to decriminalize the practice of journalism and freedom of expression. Today, there is more freedom of expression in Somalia and change in editorial content – from reporting on macabre scenes of war to development content. Gradually, the media has reclaimed its rightful position in advancing Somalia’s progress and development.

This is just one of the positive highlights of the National Investment Promotion Strategy (NIPS), a guiding document developed by the Somalia Investment Promotion Office (SOMINVEST), which is domiciled at the Ministry of Planning, Investment and Economic Development, in consultation with FDI climate reforms stakeholders at federal and state levels of government.

The federal government of Somalia has pursued a policy of economic reforms that has broadened the government’s tax base and strengthened its administration. This has led to a steady increase in domestic revenue thereby bolstering the country’s economy and increasing the annual budget by close to $1 billion.

But most importantly, the reforms have enabled Somalia to start reengaging with global financial institutions. In March 2020, for instance, the International Monetary Fund (IMF) and the World Bank approved Somalia’s eligibility for debt relief under the Heavily Indebted Poor Countries Initiative. Indeed, this opened up doors for more lucrative investment leads.

Capital repatriation into and out of Somalia remains a challenge due to inefficient local-foreign banking partnerships. In addressing this and other concerns, the Financial Reporting Center (FRC), Somalia’s financial investigation body, hired its first investigators in 2019 and has since improved its capabilities to investigate illegal transactions, including money laundering and terrorist financing. The Central Bank of Somalia (CBS) has similarly transformed its operations, including the use of mobile money. Both interventions have and continue to improve the integrity of the financial system that will ultimately improve Somalia’s reintegration with world financial systems.

Reforms in the pipeline

Over the years, priority has been placed on improving security, law and order as well as reforming legal, regulatory, administrative, procedural and institutional barriers that affected all phases of the foreign direct investment life cycle.

The 9th National Development Plan, the National Investment Promotion Strategy (NIPS) and other strategic national documents, including the Growth and Economic Transformation Strategy (GETS) – a long term, broad-based and multi-sectoral vision with the goal of creating a prosperous, secure, democratic and inclusive country with high quality of life – provide hopes and aspirations to the millions of Somalis who are participating in the different spheres of national development, every day.

The government’s resolve to accelerate reforms to attract private capital is indeed encouraging. All proposals and indicative targets to increase FDI crafted under the NIPS are informed and comply with the country’s 9th National Development Plan.

As Somalia recovers from the triple shocks of COVID-19 economic disruptions, recurrent droughts and locust infestations, the FGS is committed to introducing policy reforms that raise productivity, increase jobs and expand fiscal space that would allow infrastructural investments. These include interventions focused on reducing the cost of electricity, improving its accessibility and reliability, leveling the playing field among private firms, reducing red tape, and broadening financial inclusion as well as infrastructural development while boosting the institutional capacities of economic development institutions.

Improved infrastructure, especially the transport sector – roads, airports, ports, bridges and information communications technology (ICT) – eases the costs of doing business, enhances market connectivity and service delivery, and augments the competitiveness of Somali firms.

The FGS has equally been fast at embracing technology – mainly the e-government and e-commerce initiatives. The adoption of cashless mobile-based technology, internet-based solutions and service to members of the public, as well the establishment of one-stop shops for investors and interoperable service delivery portals, are some of the reformed approaches that greatly improved service delivery and spurred investment.

Somalia is among the pioneer African countries to establish mobile money, which has transformed the lives of many, besides facilitating business for corporations and small and medium-sized enterprises (SMEs), as well as contributing to the country’s economic recovery.

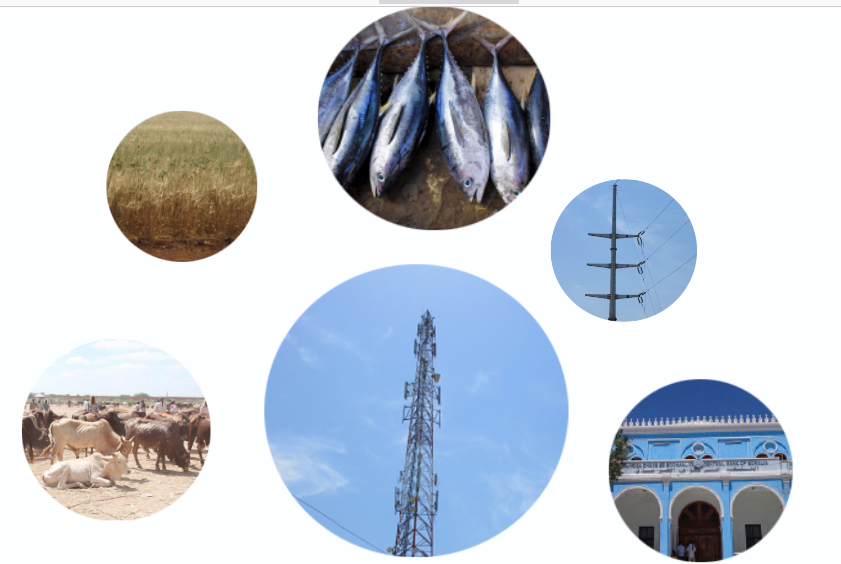

Top officials in the FGS have equally expressed the government’s commitment to a number of ongoing reforms, including the IMF’s Staff Monitored Program (SMP), Public Finance Management (PFM), and Public Administration Reform (PAR) as well as considerable investments geared at improving the business environment in the key productive sectors of farming, livestock, and fisheries and enabling sectors of energy, ICT as well as financial and banking sector.

These reforms are crucial for improved trade locally and regionally and indeed, it is this thirst for widening its market scope regionally that largely inspired Somalia’s quest to seek membership in the East African Community in 2013, join the Common Market for Eastern and Southern Africa (COMESA) – a free trade zone comprising of 21 African nations – in 2018, and cabinet approval of the Africa Continental Free Trade Area Agreement in 2020.

While FDI relies heavily on the success of the ongoing government-led economic recovery reforms, and support from the international partners, there is no doubt that rays of light are now sharply permeating through the darkness that has impeded diaspora, domestic and foreign direct investments in Somalia.

About the author

Director of the Somalia Investment Promotion Office (SOMINVEST) at the Ministry of Planning, Investment and Economic Development

First published in Daily Sabah